The digital development towards connected products, or IoT, and platforms has led to realisation of a relatively new concept within the context of supply chain management known as mass customisation. Essentially mass customisation is creation of personalised and “customized products with production cost and monetary price simi-lar to those of mass-produced products’’ . In general, there are two main strategy approaches for achieving mass customisation, which are a tailoring strategy or a platform strategy.

Tailoring Strategy

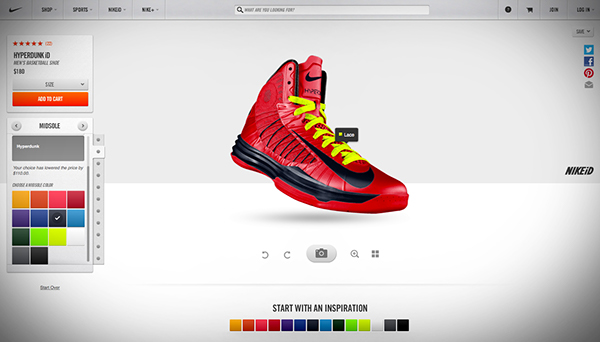

A tailoring strategy implies that detailed information is analysed in order to create customised and personalised products for each individual user before entering the consumption space. An example of this are shoe manufacturers Nike and Adidas, with their tailoring platforms NIKEiD and miadidas (see featureing picture of this blog post). This means that intel on the real needs of the customer could be understood and utilised to fullest extent, in order to generate maximum value for the end user. This concept is obviously much more effective and valuable compared to how the traditional tailoring is done and performed, where the tailoring process is simply based on suggestion about existing varieties. However, note that the tailoring strategy is in this context closely related to the goods-dominant logic approach because of the focus on value-exchange.

Platform Strategy

A platform strategy distinguishes in that sense that it takes more of a service dominant logic, or value-in-use, approach compared to the tailoring strategy and that the customi-sation process can occur in the customisation space or postponed indefinitely. Thus the fundamental principle of a platform strategy is that the provider offers a standardized, or a “incomplete product”, that can flexibly be updated and boosted later on after the product has transferred and is being used by the consumer.

So What Are Incomplete products Then?

The concept of an incomplete product is an extension of a postponement strategy, which strives for producing standardized products and delaying much of the movement or configuration of the final product within the frame of the supply chain. The difference between postponement and incomplete products is that the customisation process can be executed even when the product has exited the traditional supply chain domain. In other words, the customisation takes place in the consumption space, which has been made possible thanks to the recent digital advancements. Thus an incomplete product is defined as “a physical product, design with a modular architecture, capable of dynamic reconfigurability allowing for the offering to obtain an optimal fit within the actors’ dynamic and ever changing context of use where the transaction boundaries are aligned with the context of use”. In the previous context the concept of “dynamic reconfigurability” for an incomplete product is referred to “the capability to modify their functionalities, adding or removing components and modify interconnec-tions among them”.That is to say, a software platform is the holistic core that provides with these new configuration features and customisations possibilities for the incomplete product.

An example of an incomplete product is Tesla cars. In 2013, there were concerns that the Tesla cars were to low, which resulted that the litium batteries could ignite and catch fire because of the heat. The solution to this problem was a code fix over “the air” which lifted the springs of the car by a few inches, so that the risk was fully prevented.

Summary

It can be concluded that both presented strategies may use a software platform for offering products and services with different variety. The actual distinction is in how the custom-isation and variety is executed: is it before the consumption space or in it? Therefore, the current school of mass customisation is mostly focused around tailoring strategies, despite the fact that numerous successful platform strategies already exist and has proven to be very profitable and effective, such as Apples iPhones in combination with the iTunes platform. Therefore, one can expect that more platform strategies and incomplete products concept will be applied on a greater scale in the future.

/Drill